Most physicians would love nothing more than to be able to pay a fair price for good advice and have their financial expert take care of all of these financial chores. As I have previously discussed in this column, it is perfectly fine to use a financial advisor, but that does not exempt you from doing CFE. First, it requires a certain amount of financial education to pick a qualified financial planner and/or asset manager among the many salespeople out there masquerading as advisors. It also requires some knowledge to identify a fair price for those services. Second, and more important, your advisor cannot do the most important financial tasks ahead of you, like spending much less than you earn, without your help.

Explore This Issue

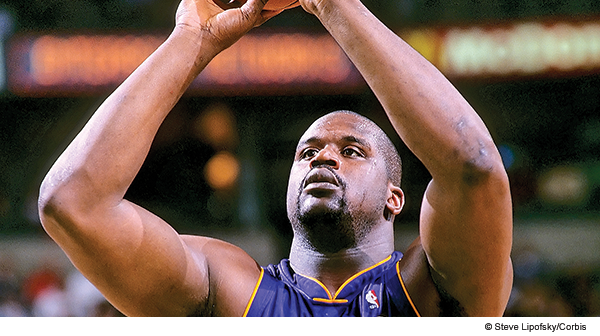

ACEP Now: Vol 33 – No 08 – August 2014Dr. Shaq might have blown his first million in a half hour. But after he wised up, he became quite good at converting his high income into income-producing assets. Physicians who wish to become financially independent someday must do the same. That means you cannot spend it all; you must carve out a significant portion of your income and dedicate it toward building wealth by paying off debt; funding retirement accounts; and purchasing income-producing assets like stocks, bonds, small businesses, and real estate. If you aren’t sure how much you should be saving, start with 20 percent of your gross income.

Any time you have a lump sum of money, you are faced with a choice. You can spend the lump sum now, or you can invest the money and instead spend the increase from the investment. Your choice isn’t $20,000 now or $20,000 later. It’s $20,000 now or $2,000 per year (or whatever return you achieve) for the rest of your life. The best part about investing (at least successfully investing) is that the original $20,000 is still there. If you change your mind, you can always blow it on a boat later after it produces some income for a few years. Successful personal finance is a lot like weight loss. It is the cumulative effect of thousands of tiny decisions. It is simple but not easy. Just as weight loss follows the first law of thermodynamics, continually spending much less than you earn eventually leads to wealth and, more important, financial freedom.

Frugality is the cornerstone of personal finance. The great thing about frugality, at least when applied both to Shaq and the typical doctor, is that it is all about relative frugality, not absolute frugality. Doctors don’t have to wear secondhand clothes or clip coupons in order to spend much less than they earn. Following a simple, reasonable budget will do. I often receive inquiries from residents wondering who they can borrow money from to meet their living expenses. I try to gently remind them that their resident salary alone is the equivalent of the average American household income. Half of the people in our country live on less than a resident salary; there is no reason they should not be able to do so for a few years, even in a high-cost-of-living area. However, they can’t expect to put their four kids into private school, own three cars, have two smart phones with expensive data plans, and still live within their means. You can live like you are rich or you can be rich, but very few will ever be able to do both.

Pages: 1 2 3 | Single Page

No Responses to “Tips for Financial Success from NBA Star Shaquille O’Neal”