Question: I am 55 years old and would like to retire. I just finished paying off my house and have $1.5 million in my retirement accounts. Is that enough?

Explore This Issue

ACEP Now: Vol 33 – No 06 – June 2014Unfortunately, more information is required to find the correct answer to this question. Although there are many rules of thumb, such as you need 20 times your annual income to retire, these rules are useless for the typical American and even worse for a physician. Twenty times a typical emergency physician income of $275,000 is $5.5 million, far more than the vast majority of physicians need to enjoy a wonderful retirement. The best way to figure out how large your nest egg needs to be in order to retire without having to worry about ever running out of money is to first determine your expenses in retirement and then determine if you have the resources to pay those expenses.

The Good News

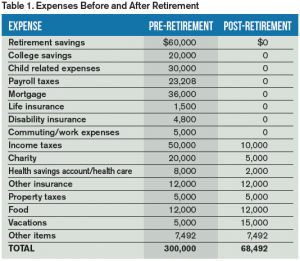

The best estimate of your expenses in retirement is what you are spending just before retirement along with some common-sense adjustments. The good news for physicians is that the majority of their expenses may completely disappear upon reaching financial independence and retiring. Consider Table 1, an example of a physician making $300,000 and his pre-retirement and post-retirement expenses.

This particular physician finds that he only needs $68,492 per year, or 23 percent of his pre-retirement income, to maintain his standard of living. However, that 23 percent is by no means a rule of thumb and is highly individualized. You may find you only need 20 percent of your pre-retirement income, or perhaps you may need as much as 50 percent. However, it is unlikely that you will need the 70 to 80 percent that some financial planners estimate once you subtract your savings, insurance costs, payroll taxes, mortgage payments, and expenses related to your children.

The Bad News

There is also some bad news associated with retirement planning. Financial professionals use a concept called the safe withdrawal rate, which is the amount of money you can withdraw from a reasonable portfolio each year, adjusted to inflation, while expecting that portfolio to last throughout your retirement. Although this number varies slightly over time and no one can predict future market returns, most experts agree the number is somewhere around 4 percent. That means a portfolio of $1 million can safely support an income of only about $40,000 per year, adjusted upward each year for inflation. Using this number, you can quickly see that an annual income of $120,000 will require a portfolio of $3 million. To make matters worse, if all or most of that portfolio is in tax-deferred accounts like 401(k)s and traditional IRAs, the after-tax income will be even lower.

Other Income Sources

Other sources of income decrease the expenses your portfolio must pay for. The most common of these is Social Security. The Social Security Administration sends you a statement each year with an estimate of the income you will receive at your full retirement age. There are a few things to keep in mind when evaluating that figure. First, it assumes you will continue working until your full retirement age. If you retire early, such as at age 55, that number may be significantly lower. Social Security averages the highest 35 years of earnings in determining your payment. If you only work for 25 years, Social Security will use 10 years’ worth of $0 earnings to determine your payment.

Retirement rules of thumb say you need 20 times your annual income to retire. Twenty times a typical emergency physician income of $275,000 is $5.5 million, far more than the vast majority of physicians need to enjoy a wonderful retirement.

Second, delaying Social Security payments to age 70 is one of the best ways to insure against your own longevity. But if you plan on retiring at 50 or even 60, you will need a plan to bridge the gap to Social Security at age 70 (not to mention Medicare at age 65).

Third, while many fear that Social Security will disappear completely, this seems highly unlikely given the popularity of the program. However, changes to the program are inevitable and may include raising the retirement age, lowering payments, and/or increasing the amount of Social Security tax paid. The bottom line is you should expect Social Security to provide an income of $20,000 to $40,000, at least in the latter half of your retirement years.

Other sources of income include pensions, the income of a spouse who continues to work after you retire, inheritances, and rental property. Each of these can be used to reduce the amount of income required from your portfolio.

Other Options

Once you have determined your expenses and matched them against other sources of income, you may find that your portfolio is not large enough to support your remaining needs. There are a couple of options to make up the difference, but both involve giving up control of assets.

The first is to use a portion of your portfolio to purchase a single premium immediate annuity (SPIA). This is an insurance contract where you pay the insurance company a lump sum of money and, in exchange, the company pays you set amount of money each month for the rest of your life. While many annuities are complicated high-expense products designed to be sold and not bought, SPIAs are a straightforward and competitively priced way to purchase a pension. Unlike life insurance, which becomes more expensive as you get older and sicker, SPIAs become less expensive as you age and develop illnesses. The major benefit of a SPIA is that, unlike portfolio withdrawals, the income is guaranteed (although when you die, your heirs do not receive anything). A SPIA purchased on a healthy 70-year-old male currently pays about 8.3 percent per year, more than twice as much as the safe withdrawal rate of 4 percent.

Another method of increasing income is to use a reverse mortgage. While this industry has been appropriately maligned for high fees and inappropriate sales practices, a reverse mortgage allows you to convert your home equity into income while staying in your home as long as you are able.

A better option for most doctors facing a retirement shortfall is to work a few more years. A few more years of work, even part-time work, can make a huge difference in your spending level in retirement. Working longer allows for more savings, more time for prior savings to compound, and fewer years in which your portfolio must support you. Five more years of work could increase retirement income by 80 percent or more.

The nonfinancial aspects of retirement should not be ignored. Losing your identity as a practicing physician is difficult for many. Filling your time with worthwhile activities is hard for others. Your relationship with your spouse may also undergo a difficult adjustment when you work less. Emergency physicians and other shift workers are lucky in that they can often ease themselves into retirement by gradually reducing shifts, minimizing these issues compared to many specialists.

Appropriate retirement planning, done on your own or with an appropriate professional, will minimize financial worries in your later years.

Dr. Dahle is the author of The White Coat Investor: A Doctor’s Guide to Personal Finance and Investing and blogs at http://whitecoatinvestor.com. He is not a licensed financial adviser, accountant, or attorney and recommends you consult with your own advisers prior to acting on any information you read here.

Pages: 1 2 3 | Multi-Page

One Response to “How Much Money Do Physicians Need to Retire?”

February 2, 2018

David LippmanDr Dahle,

Thank you for the article. I appreciate it and your work at The White Coat Investor.

Perhaps I missed it, but in retirement expenses it appears that health care insurance/HSA was only $2k in retirement. Doesn’t that seem low, particularly for a 55 year old who had a high income? I would imagine that it could be closer to $10k if he/she has to purchase it on the exchange. Am I wrong?

I may be reading between the lines, but it appears that for a 68K lifestyle you would recommend a savings of approx $1.7 million. Lastly, I find it interesting that only approximately 22% of ER physicians have a net worth of $2 million or more per the Medstudy Physician and Wealth 2017 Report (and only 12% of Fam Practice and 15% of IM docs have such an amount saved).

Personally, I think, as physicians, we need more education and action in retirement savings regardless of our specialty.

Thanks for your work!